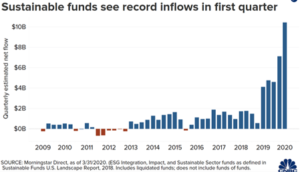

We are living in a transformative time and Covid-19 may be the impetus that leads investors to change their perspective on ESG (environmental, social and governance) investing. Companies have been shifting away from only focusing on the bottom line and are now considering the larger picture. Investment in sustainable funds saw a record increase during the first quarter of 2020. According to Morningstar, global sustainable funds saw inflows of $45.7 billion, while the broader fund universe had an outflow of $384.7 billion. During the second quarter of 2020, 56% of sustainable funds ranked in the top half of their Morningstar category. Year-to-date, that number jumps to 72%.

Whether blockchain becomes the tool to track, trace and verify CO2 emissions and carbon offsets remain to be seen. But whatever the technologies implemented investors and foundations must be assured that some risk is removed from investing in companies that are developing new technologies to combat the overall climate issues. One of the best ways to counter risk is to understand the overall market factors that will impact investment. The broad risk categories are outlined below and within each category, the specific investment risks.

A number of companies exist that can assist in de-risking investments. For one, Trucost is a company which estimates the hidden costs of unsustainable use of natural resources by companies. It is part of S&P Global, assessing risks relating to climate change, natural resource constraints, and broader environmental, social, and governance factors.

Despite the positive inflow of capital into sustainable investing, there are still some questions around de-risking. To start with, there are a number of rating systems. ESG ratings take into account and audit a number of factors including supply chain management and governance. Companies must also comply with frameworks such as the Sustainable Accounting Standards Board. The established tools for determining climate impact doesn’t account for startups where the technology and product deployment isn’t yet realized. A new organization, CRANE, developed a climate impact assessment tool to assess climate impact of early-stage companies and to inform investors about the potential for their investments to mitigate future emissions.

Currently many in the financial sector rely on their auditing partners to comply with ESG ratings. There are some basic green loan principles already in place removing the need for investors to conduct significant due diligence. The guidelines laid out by the LSTA and outlined in their associated paper is a collaboration among most major financial institutions. Just recently, Bank of America, the four large accounting firms and the World Economic Forum collaborated on a set of standards for measuring ESG’s. The framework’s criteria include reporting information on greenhouse gas emissions and other climate factors including, water use in distressed areas or the number of sites a firm owns, leases or manages near designated biodiversity sites. The desire is to create a uniform set of standards and it is likely that the EU will lead this effort and any multinational company will need to comply.

There is also a trend among the broader financial community toward disclosure. Earlier this year Citibank, Bank of America and Morgan Stanley joined the Partnership for Carbon Accounting Financials, a global framework for financial institutions to measure and disclose the emissions from their lending and investment portfolios. This creates a domino effect. As banks/brokers or institutional investors disclose their metrics, others follow suit. For instance, an institution may elect not to invest in coal, then they might move on to eliminating oil & gas. Natixis has systems where they require fewer assets from lenders for “green” as opposed to “brown” portfolios and through its subsidiary works with Mirova.

To supplement a foundation’s overall knowledge of de-risking, they can look to a credible company like Blackhorn Ventures which invests in companies that use technology to establish new benchmarks of efficiency and resource productivity, ultimately increasing profit margins. The investments focus on transforming industries such as, construction, manufacturing, healthcare, agriculture, transportation, water and energy.

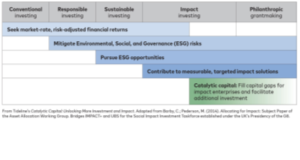

Beyond the financial sector, other groups are focusing on creating market development initiatives. The Catalytic Capital Consortium, conceived by the McArthur Foundation, looks to bridge the capital gaps between investing for impact without losing financial results. They utilize “field partners” to assist in investing.

Additionally, there are many organizations that can assist foundations and philanthropies to gain a greater understanding of the risk factors while detangling the investment complexity. Peer networks and educational platforms to boost learning exist such as CREO, Confluence Philanthropy and Prime Coalition.

Nothing is a sure bet, but the trend is increasingly to invest in ESG’s, where the returns are on a par with other investments and by doing so, foundations take a positive step toward improving both the climate and the broader world in which we live.