As the year 2020 nears its inevitable end it’s nice to reflect back and take note of things that worked, things that didn’t work and stuff to just plain, avoid. While 2020 has produced a seemingly unmeasurable amount of “things to avoid” it also marks one year closer to deadlines for carbon neutrality.

Deadlines enforced by both human and natural forces. Human organizations = policy, regulation, laws. Nature = climate change, extreme weather, and future inability for the planet to support human life.

Whether it was the thought of impending doom, or the fear of an avoidable financial burden, a few observations ring true. One, a growing number of companies are publicly setting organizational carbon goals. Two, many of the organizations setting these goals have NO concrete plan of how to reach them. And three, efficacy of offset and the carbon market is beginning to shape up.

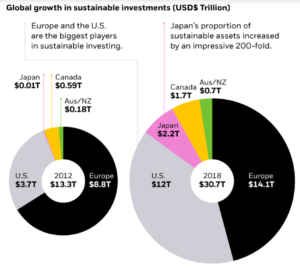

No doubt the first two come as little surprise. Almost daily the news reports of another massive corporation like IBM, Apple, Microsoft, Walmart, Nestle or Starbucks are capturing headline news with one huge carbon reduction goal after another. Many corporations have adjusted their perspective from viewing sustainability as a burden, to realizing it creates a competitive edge by differentiating them from their competitors. This phenomenon is being observed with municipalities as well. While it is amazing and wonderful that so much interest is being shown in sustainability, the fact remains that many of these organizations are struggling with how they will, in fact, be able to reduce their footprint to zero.

A recent collaboration between LightWorks and Luminosity Lab sought to understand what organizations had in place to meet their newly publicized goals. The project is an element of a larger portfolio of work developed by LightWorks, Digital Carbon Warehouse (DCW). The DCW: interviews ask – “what, if anything is in place to help ensure a successful transition to net zero carbon”. The team interviewed people in a variety of roles within large national and global companies from multiple industry sectors. the team learned no matter what company, industry sector or operating region an organization was based in, a resounding majority acknowledge that offsets will have a role in the future of their company’s carbon neutrality.

Now, to be fair, acknowledging that offsets will play a role and accepting them in their current state are two completely different acts that won’t be sharing the same stage.

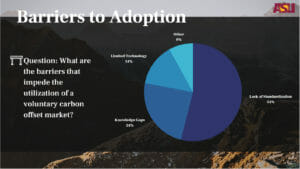

More than half of the responses gathered from the DCW: interviews found the lack of standardization to be the #1 barrier to adoption. Standardization, or the industry wide level setting to establish a single cohesive language governing operation. Currently the market has no agreed upon set of protocols defining how carbon sequestration is measured, tracked and traced, not to mention there is still no universally accepted carbon price. Without the ability to ensure consistent, efficient reporting and provide trustworthy evidence of sequestration, or operate in a steady market, gaining corporate buy-in will be extremely difficult.

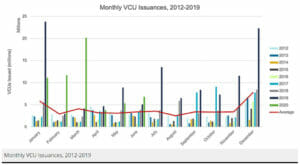

Not to fret, change is in the air. This year has ushered in unprecedented changes to conventional thinking in a myriad of realms. Carbon markets are no stranger to this trend. News of a merger between major market actors Sustainability Accounting and Standards Board (SASB) and the International Integrated Reporting Council (IIRC) in late November are strong indicators of positive change. Further, the oil and gas giants BP, in a press release this December, announced their acquisition of more than 50% of the forest trust Finite Carbon. Finite will be attached to BP’s accelerator arm with a targeted expansion of $1B in revenue to small landowners by 2030.

Successes like the SASB & IIRC merger or BP acquisition send a trend-setting messages that resonate with industry peers. As more companies take on the challenges of meeting their carbon goals, collectively we inch closer to addressing the gaps throughout the carbon market ecosystem. Universities will play a significant role in identifying transition pathways and are proving to be an influential partner to organizations of all shapes and sizes. Applying innovation, collaboration, and trust to develop frameworks and collaborations necessary to facilitate the world’s transition to a carbon free economy.

While yes, 2020 was an “interesting year”, optimistic perspectives are bringing a carbon neutral future into view. Clearly, significant, challenging and potentially painful adjustments are undoubtedly in store – it can be argued having a focus on a viable path will help to quiet the chattering chaos that envelops periods of unrest, turmoil, and change.